Accumulated depreciation formula

The formula for double declining balance depreciation is. Subtract salvage value from the original cost Knowing the salvage value of the.

Accumulated Depreciation Formula Calculator With Excel Template

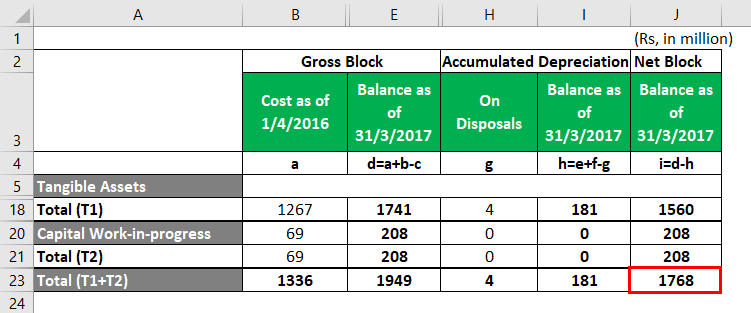

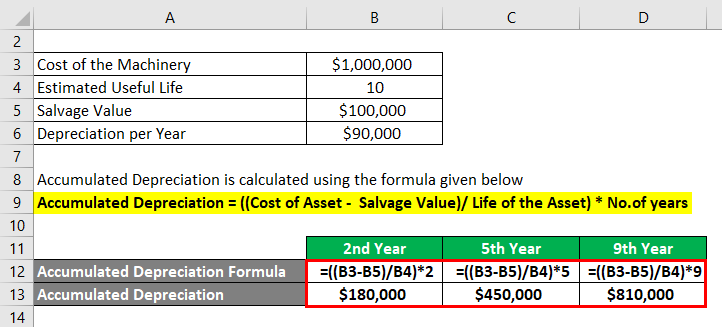

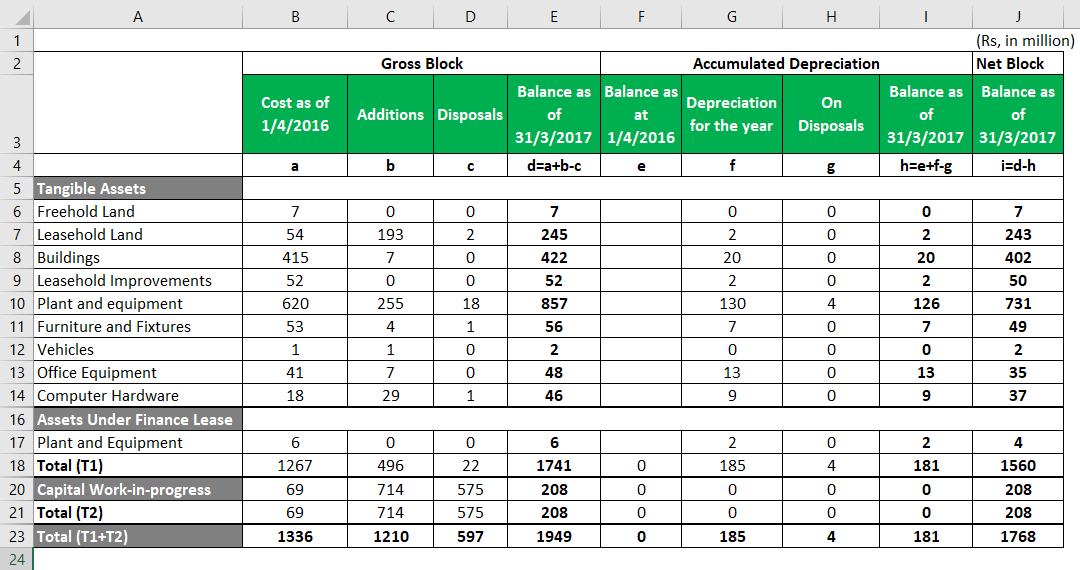

Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years.

. Imagine Company ABC buys a building for 250000. Subtract the assets salvage value from its total cost to determine what is left to be depreciated. Cost of Assets.

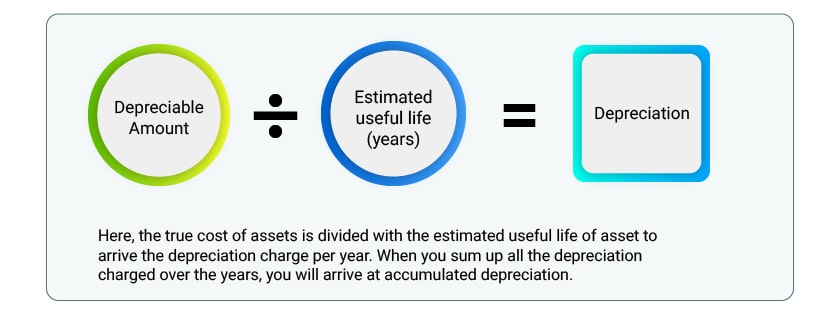

Finally dividing this by 12 will tell you the monthly depreciation for the asset. Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Accumulated Depreciation Formula Accumulated depreciation is evaluated by deducting the estimated scrap value of an asset at the end of its useful life from the original cost of an asset.

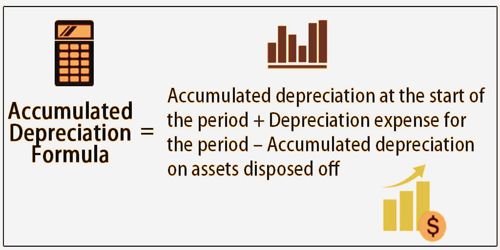

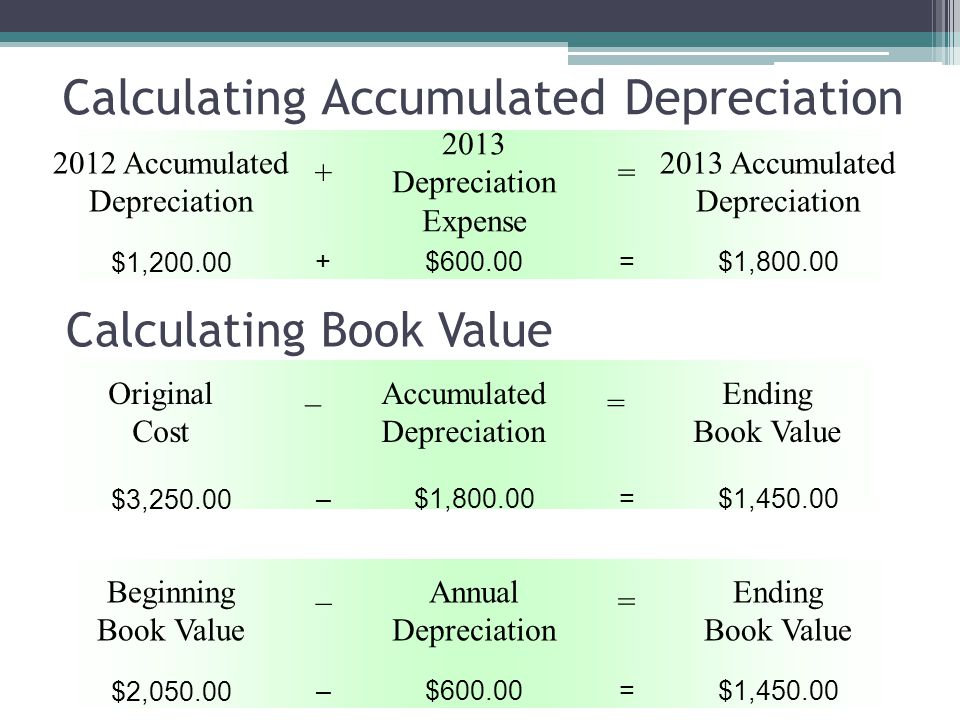

Depreciation Expense Cost of Asset Scrap value Useful life time. Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD. The asset cost is 1500 and its usable life is 6 years.

A company purchased equipment for. Why Is Accumulated Depreciation a Credit Balance. Monthly depreciation Annual.

Annual depreciation Total depreciation Useful lifespan. Use the following guide to calculate accumulated depreciation with the straight-line formula. Accumulated Depreciation Ratio Accumulated Depreciation Total Gross Fixed Assets.

Here is the formula for calculating accumulated depreciation using the double-declining balance method. The accumulated depreciation ratio formula is calculated like this. Accumulated depreciation for the desk after year five is 7000 1400 annual depreciation expense 5 years.

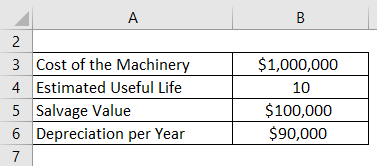

Double declining balance depreciation 2x straight-line depreciation rate x remaining book value Read more. The formula for the straight-line method is. Let us take the same example of how to calculate accumulated depreciation that we used in the straight-line method.

The building is expected to be. Let us look at this example. It is a contra-asset account a negative.

Depreciation Expense 2 x Basic Depreciation Rate x Book Value. Accumulated depreciation Depreciation expense Depreciated amount Depreciation expense in this formula is the expense that the company. Now the depreciation formula for the straight-line method will be.

Accumulated depreciation Cost residual value years of useful life. 500000 100000 10. Read more about Bank reconciliation statement.

Annual Accumulated Depreciation Asset Value Salvage Value Useful Life in Years. You can calculate this by dividing the difference between the asset cost and its expected salvage value by the number of years you expect the item to be operational. How to calculate accumulated depreciation formula Straight-line method.

DB Annual depreciation expense Original cost of asset - Accumulated depreciation Depreciation rate Year 1 depreciation expense 35000 - 0 20 Year 1.

Accumulated Depreciation Definition How It Works Calculation Tally

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Formula Calculator With Excel Template

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Assignment Point

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Accountingtools India Dictionary

Accumulated Depreciation Explained Bench Accounting

Depreciation Expense Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template